Over the past weeks through to today, the threat of a global economic downturn has been top-of-mind for people in business and finance. The key figure in all this? US inflation.

As per the U.S. Consumer Price Index (CPI), the weighted average price of goods and services bought by U.S. households has risen by 8.6%. This is troubling, as the CPI works as an indicator for inflation.

And history has taught us that, when the US economy goes through instances of inflation and unhealthy uncertainty, that is reflected in the U.S. markets and in emerging economies like the UAE. For consumers, this usually takes the form of rising costs of basic needs like food, petrol, and electricity.

For traders, on the other hand, this sparks a de-risking of portfolios in line with loss mitigation strategies. That’s why you’ve seen recent sell-offs in the markets.

In times like these, what should your approach be as an investor? How can you protect yourself from inflation?

By structuring a portfolio with inflation-hedge assets.

Building an inflation-proof portfolio

Inflation can be most damaging to the value of fixed-rate debt securities because it devalues interest rate payments as well repayments of principal. It suggests that if the inflation rate exceeds the interest rate, lenders lose money after adjusting for inflation.

With that in mind, here are asset classes have continuously risen in value and outperformed the market during inflationary climates.

Real Estate

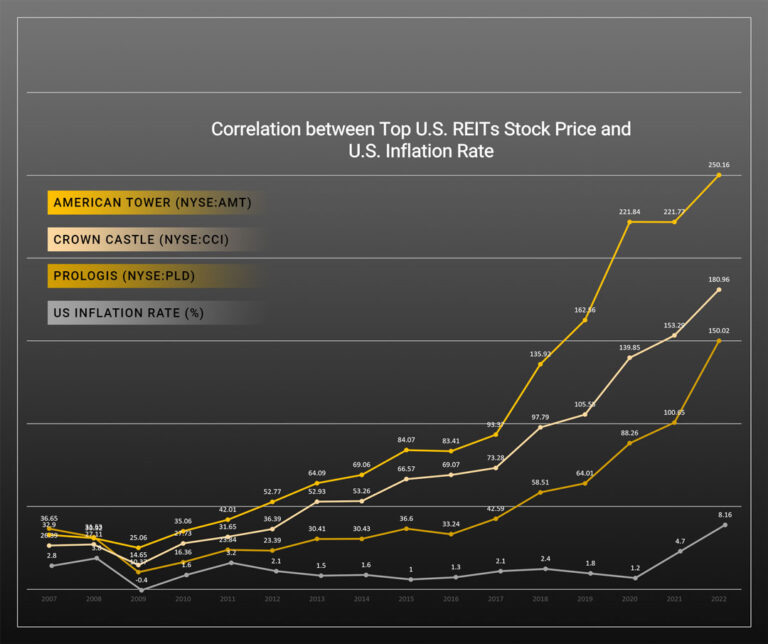

Real Estate is a popular investment choice to hedge against inflation. Historically, this type of investment performs well in an inflationary cycle and will remain an important part of asset portfolios for years to come.

If you have enough funds, the simplest way is to opt for direct buy-ins of real estate assets. If you don’t have the capacity for a direct buy-in, another option is to purchase shares of a real estate investment trust (REIT). REITs are a simpler way for regular investors to diversify their portfolios and get the inflation hedge benefits of real estate, without holding the actual assets themselves.

Since 2007, the value of the largest publicly traded REITs in the U.S. have shown strong correlation with U.S. inflation rates. As inflation intensified, stock prices for top REITs grew in value as well.

Commodities

Commodities are a broad range of raw materials and agricultural products like oil, metal, and wheat that can be publicly traded. The values of these commodities tend to rise alongside the prices of finished products made from those commodities in inflationary environments.

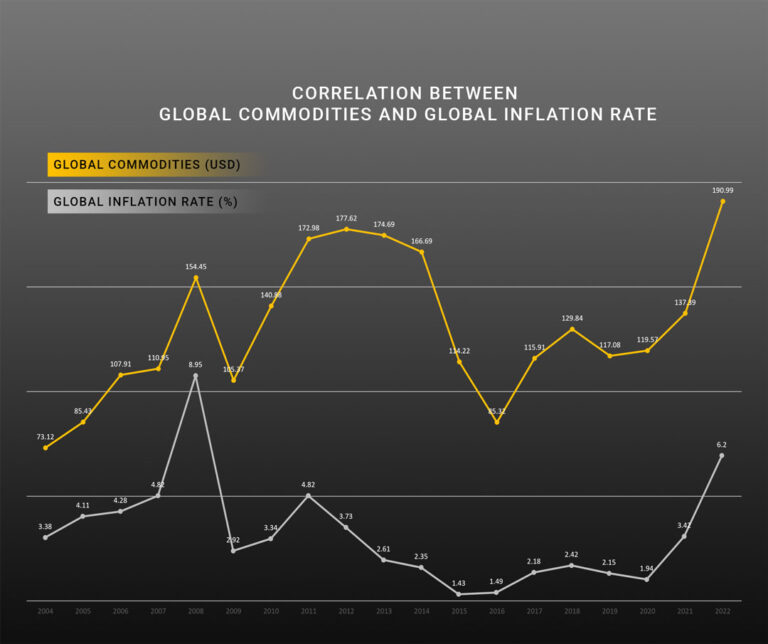

As you can see in the graph above, there is a strong correlation between the value of global commodities and the world inflation rate from 2004 to 2022. This is because, as the demand for various products increases, the need for commodities used to produce them also increases, resulting in rising commodity prices. Gold and other precious metals have long been leading commodities for mitigating the effect of inflation in portfolios. Gold, for instance, has seen an annual gain of 9.48% over the 20 years between September 2001 and September 2021, while inflation averaged 2.4%, netting investors a 7.08% rate of return.

Like real estate, gold can be purchased directly or indirectly by investing in a mutual fund or an exchange-traded fund (ETF) that owns gold. Gold-focused mutual funds and ETFs are considered more economical than purchasing physical gold, as they can significantly reduce the additional costs of storing and insuring coins and bullion. However, investors also need to remember that the price of gold is highly volatile, especially over the short-term.

Bonds

Bonds are commonly thought as counterintuitive investments during inflation due to the latter’s effect on fixed-rate debt. However, there are inflation-indexed bonds that offer a variable interest rate tied to the inflation rate. These are investment types that can deliver safe returns with little to no risk, as they guarantee a rate of return higher than the rate of inflation if held to maturity.

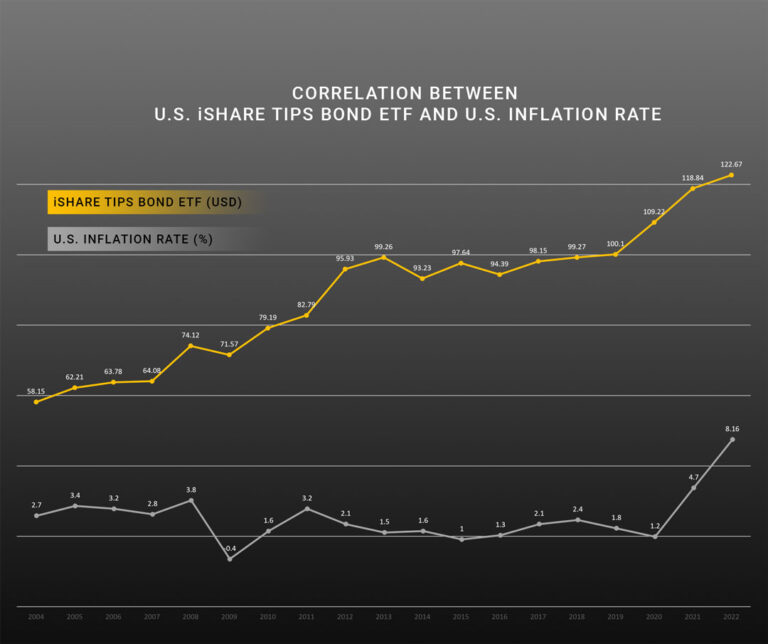

One asset that falls under this category are Treasury Inflation-Protected Securities or TIPS. These securities can be bought directly from the U.S. Treasury or through a qualified bank, broker, or dealer. Alternatively, you can gain exposure to TIPS through an ETF. The iShares TIPS Bond ETF, for example, is a publicly traded fund that tracks the investment results of the Bloomberg U.S. Treasury Protected Securities (TIPS) Index (Series-L), composed of inflation-protected U.S. Treasury bonds.

As seen in the graph above, there is a correlated relationship between the U.S. iShare TIPS Bond ETF and U.S. inflation. And because the U.S. federal government backs them, TIPS are considered among the safest investments in the world. TIPS bonds usually mature in 5, 10, and 30 years and interest payments are scheduled every six months.

Stocks

Investing in a diversified portfolio of stocks is an excellent way to fend off inflation. However, not all equities have a reasonable chance of keeping pace with inflation, so investors should focus on companies that can pass their rising input costs to customers like those in the consumer staples sector.

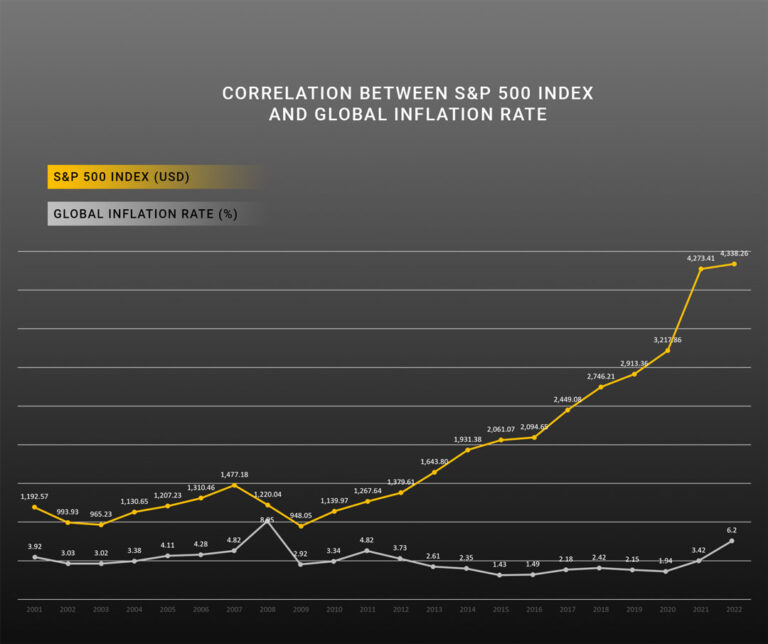

It is advisable to start investing in the S&P 500 index fund or S&P 500 ETF, which contains hundreds of stocks and provides simple and low-cost diversification. Therefore, it reduces risk and portfolio management headaches.

Exhibit 4 shows the connection between S&P 500 Index and the Global Inflation Rate. The graph indicates that investing in equities for a long-term period is an excellent way to outrun inflation. The average return of the S&P 500 Index is about 10%, higher than the 7.9% annual inflation rate seen in February this year.

Final Thoughts

As inflation progressively becomes one of the most pressing concerns across the globe, investors need to be more proactive by maintaining a holistic view of the investment space. To hedge against inflation, investors may consider a number of asset classes like real estate, commodities, bonds, and stocks. These asset classes have a higher probability of increasing in value in the face of rising prices, thus offering varying levels of protection against inflation. An adequate understanding of each asset class will be essential to properly structure the investment portfolio and minimize the effects of inflation.

Thomas Stray is the CEO and founder of Endemaj Funds, a Dubai-based investment entity with interests in disruptive technologies.

Endemaj Funds has a

disclosure policy.