Authored by Thomas Stray, Endemaj Funds CEO

Thomas Stray is a seasoned investment banker leveraging decades of experience in capital markets, financings and deal structuring, negotiation, and fund raising to identify and capitalise on market opportunities with significant upside.

I am delighted to share our weekly update at Endemaj Funds, where keeping you informed about the latest developments and sharing our insightful perspective on the financial landscape is my commitment as the CEO. This week, we will focus on three key areas of interest: exploring the concept of a ‘soft landing,’ examining the exciting potential for another bullish phase for the stock market, and delving into the optimistic outlook for the cryptocurrency market, particularly Bitcoin.

A Soft Landing for the Economy

The term “soft landing” is used in economics to describe a situation where an economy slows down, but does not enter a recession and avoids a hard landing. It’s a scenario where economic activity slows down just enough to alleviate inflationary pressures without triggering a significant increase in unemployment.

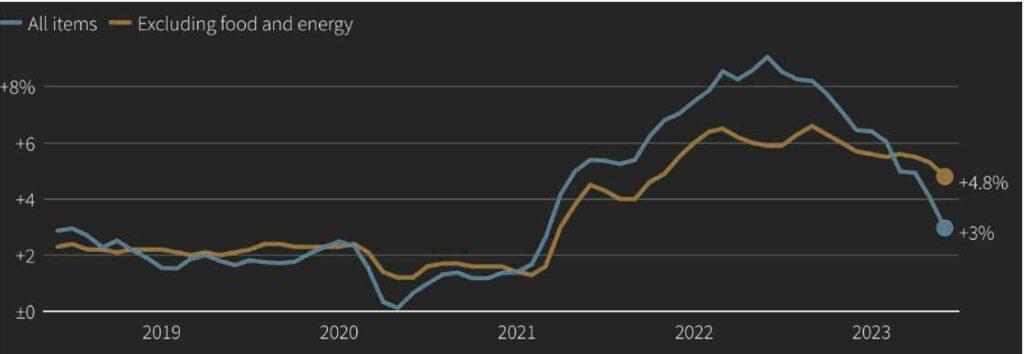

Recent data suggests that we are witnessing a soft landing in the US economy. The inflation rate, which was a significant concern earlier this year, has started to moderate. The Consumer Price Index (CPI) increased by 3% in June, the smallest year-on-year increase since March 2021 and followed a 4.0% rise in May.

Moreover, looking at the Annual Change in U.S. Consumer Price Index, ending in June, the core CPI, excluding the volatile food and energy categories, saw a rise of 4.8%, representing the smallest year-on-year gain since October 2021. This data serves as another positive sign, suggesting that the underlying inflationary pressures also show signs of moderation.

Annual Change in U.S. Consumer Price Index

The most recent CPI data provides additional evidence that the Federal Reserve’s proactive approach to rate hikes has successfully led to a consistent downward trend in inflation. After reaching a 40-year peak of 9.1% in June 2022, year-over-year CPI inflation has steadily declined for 12 consecutive months. This is a significant development as it indicates that the inflationary pressures are starting to ease.

The easing of inflation is a positive development for the economy as it reduces the pressure on the Federal Reserve to increase interest rates. When interest rates are raised too swiftly, it can potentially impede economic activity and create a scenario known as a “hard landing.” A hard landing refers to a sudden and abrupt slowdown in economic growth that can lead to negative consequences such as job losses, reduced consumer spending, and a decline in business investment.

On a global scale, the ongoing recovery of the global economy, both from the impact of the pandemic and the geopolitical tensions surrounding Russia’s invasion of Ukraine, remains on a positive trajectory. Additionally, the concerted efforts of central banks worldwide to tighten monetary policy are expected to yield positive outcomes, with inflation gradually moving closer to targeted levels.

According to the latest World Economic Outlook by the International Monetary Fund (IMF), they project that global growth will reach its lowest point at 2.8 percent this year and then experience a gradual increase to 3 percent next year. In terms of global inflation, the IMF expects a decrease, albeit at a slower pace than initially anticipated. Inflation, which stood at 8.7 percent last year, is projected to fall to 7 percent this year and further decline to 4.9 percent by 2024.

Bullish Stock Market Outlook

The easing of inflation and the soft landing scenario have created a bullish outlook for the stock market. The key stock market indices have responded positively to these developments.

Following the release of retail sales data, indicating an ongoing increase in U.S. consumer spending and reflecting resilience amidst a slowdown in inflation, the Dow Jones Industrial Average (DJIA), a widely-watched benchmark index in the U.S. for blue-chip stocks, saw a notable rise of 1.3%, or about 430 points. This encouraging data had a positive impact across the market, leading to a broad-based rally, with both the S&P 500 and the Nasdaq experiencing gains of 1.4%.

The positive sentiment in the stock market is also reflected in the performance of the banking sector. Major banks like JP Morgan, Citigroup, and Wells Fargo are expected to report their second-quarter results soon. The market will be keenly watching these results to understand how these banks managed their margins in the face of a banking crisis earlier in the quarter.

Bitcoin's Bullish Momentum

The cryptocurrency market, particularly Bitcoin, has also been showing signs of a bullish trend. Bitcoin has been on a steady upward trajectory since the start of the year. The price of Bitcoin was around $16,847 at the beginning of January 2023. By July, the price had almost doubled, reaching over $30,000.

This upward trend in Bitcoin’s price is expected to continue. The halving of Bitcoin, an event where the reward for mining new blocks is halved, is expected to occur in 2024. Historically, the price of Bitcoin has quadrupled either ahead or after the halving event. If this trend continues, we could see Bitcoin’s price reaching $120,000 in 2024, as predicted by Standard Chartered.

The bullish outlook for Bitcoin is also supported by the broader market conditions. The easing of inflation and the soft landing scenario in the economy reduces the risk of a significant increase in interest rates. This is positive for Bitcoin as higher interest rates increase the opportunity cost of holding non-interest-bearing assets like Bitcoin.

Final Thoughts

In conclusion, the current economic data suggests a soft landing for the economy, which is a positive development for both the stock and cryptocurrency markets. The easing of inflation reduces the pressure on the Federal Reserve to increase interest rates, which is bullish for the stock market. The soft landing scenario also creates a favorable environment for Bitcoin and supports a bullish outlook for its price.

As always, it’s important to keep an eye on the economic indicators and market trends. The situation can change quickly, and it’s crucial to stay informed and make investment decisions based on the latest data.

Endemaj Funds has a

disclosure policy.