Authored by Thomas Stray, Endemaj Funds CEO

Thomas Stray is a seasoned investment banker leveraging decades of experience in capital markets, financings and deal structuring, negotiation, and fund raising to identify and capitalise on market opportunities with significant upside.

The financial landscape has witnessed groundbreaking shifts in recent years, with digital currencies like Bitcoin at the forefront. Two significant developments within the realm of Bitcoin — the impending decision by the U.S. Securities and Exchange Commission (SEC) on the approval of spot Bitcoin Exchange-Traded Funds (ETFs) and the periodic Bitcoin halving — have drawn considerable attention and speculation. In this blog post, we delve into these transformative elements and their implications for the future of finance.

A Groundbreaking Moment in Financial History

The potential approval of Bitcoin ETFs is a significant milestone, signaling the maturing of cryptocurrencies as a legitimate asset class. This development could herald a new era of investment strategies, providing a structured and regulated avenue for exposure to digital assets.

The impending decision revolves around two vital conditions for introducing spot-backed Bitcoin ETFs. Firstly, the SEC needs to greenlight the 19b-4 submissions from exchanges that detail the specifics of the ETFs. Secondly, the regulatory body must approve the S-1 forms, which are the registration applications from ETF issuers, including major players like BlackRock and Fidelity.

Advocates anticipate that the green light for Bitcoin ETFs has the potential to revolutionize the digital asset sphere. According to Michael Anderson, co-founder of the crypto venture firm Framework Ventures, “The market is still seriously underestimating the potential impact of a Bitcoin ETF approval.” This approval has the capacity to prompt considerable investments from both retail and institutional investors, representing a noteworthy achievement in the integration of cryptocurrencies into conventional financial systems.

Scenario Analysis

Approval Scenario: In this scenario, if the U.S. Securities and Exchange Commission (SEC) gives the green light to Bitcoin Exchange-Traded Funds (ETFs), it signifies a major validation for the cryptocurrency industry. Here’s a breakdown of the implications:

- Influx of Investment – Approval would likely result in a surge of investments pouring into the crypto market, as ETFs are a familiar and accessible investment vehicle for many investors, including institutional ones.

- Mainstream Acceptance – The SEC’s approval would further legitimize Bitcoin and cryptocurrencies in general, making them more acceptable and appealing to a broader range of investors, including those who have been hesitant or skeptical in the past.

- Market Stability and Maturity – With institutional investors entering the space through regulated channels like ETFs, the market could experience increased stability and maturity, potentially reducing the extreme volatility often associated with cryptocurrencies.

- Short-Term Volatility – A denial could lead to short-term market volatility, as investors who anticipated

approval might react by selling off their holdings. This could result in price fluctuations and increased uncertainty in the market. - Need for Continued Dialogue – A denial would highlight the existing regulatory concerns and the complexities involved in integrating cryptocurrencies into the traditional financial system. It would emphasize the necessity for ongoing dialogue between industry stakeholders, regulators, and policymakers to address these concerns and find a middle ground.

- Potential for Future Approvals – While a denial at this juncture might dampen sentiments temporarily, it does not necessarily rule out the possibility of future approvals. It may serve as a catalyst for the industry to work collaboratively on addressing regulatory issues, potentially paving the way for eventual approval down the line.

The Mechanics of Bitcoin ETFs

An ETF is a type of investment fund that is traded on stock exchanges, similar to individual stocks. It comprises assets like stocks, commodities, or bonds and typically functions with an arbitrage mechanism to maintain its trading value close to its net asset value, though occasional deviations may occur.

For the average investor, ETFs provide a convenient means to attain diversified exposure to specific sectors, commodities, or other asset classes without the necessity of direct ownership of those assets.

The approval of Bitcoin ETFs could represent a pivotal point for the industry, bringing forth numerous advantages:

- Enhanced Credibility – Acknowledgment from regulatory authorities might bolster Bitcoin’s credibility in the eyes of conventional investors.

- Wider Reach – ETFs could open Bitcoin investments to a more extensive demographic, especially individuals acquainted with conventional investment instruments.

- Stabilized Market – The participation of institutional players could foster greater market stability and reduced volatility.

A Bitcoin ETF presents an avenue for investors to participate in Bitcoin’s price dynamics without the need to possess the actual cryptocurrency. By sidestepping the intricacies and security challenges associated with managing digital wallets, it extends its appeal to a broader investor spectrum, encompassing those inclined towards traditional investment avenues.

Anticipated to unleash considerable institutional and retail investments, this development holds the potential to enhance liquidity and foster market maturity. The accompanying influx of capital might further play a role in stabilizing prices within a market historically known for its pronounced volatility.

Key Players in the Emerging Bitcoin ETF Market

Prominent companies from both the cryptocurrency and traditional finance sectors are spearheading the final push for Bitcoin ETFs. This includes:

- BlackRock – The world’s largest asset manager, recently delving into the crypto space.

- Grayscale – A leader in digital currency investing, famous for its Bitcoin Trust.

- ArkInvest – Spearheaded by the influential Cathy Wood, known for its tech-centric investment strategies.

- Fidelity – A financial giant that has shown increasing interest in cryptocurrencies.

- VanEck – A well-known investment management firm with a penchant for innovations in ETFs.

The Bitcoin Halving: A Paradigm Shift

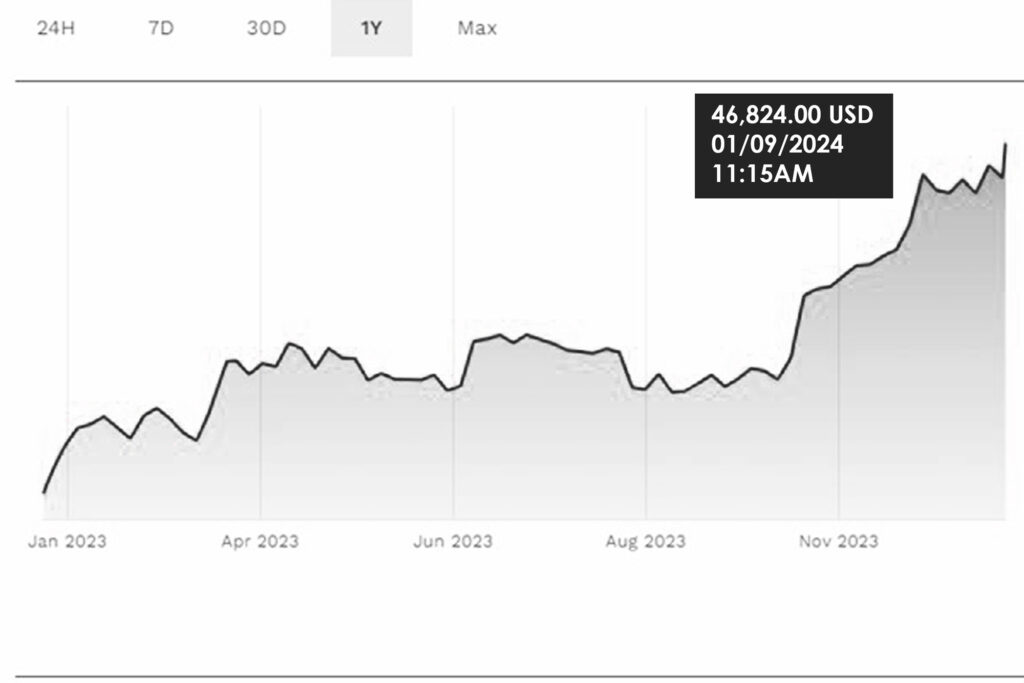

The imminent approval of Bitcoin ETFs and the impending Bitcoin Halving event have generated considerable excitement in the crypto market. With the ETF excitement escalating, Milkybull Crypto, a well-regarded crypto analyst, foresees these developments, propelling the price of Bitcoin (BTC) to $80,000 in 2024 and $200,000 by 2025.

Past halving events have been catalysts for significant price increases in Bitcoin. Reduced supply and sustained or increased demand have historically led to bullish market trends. The upcoming halving is widely anticipated to follow this pattern, mainly when considered alongside the potential approval of Bitcoin ETFs.

Analyzing the historical backdrop of Bitcoin Halving events reveals a pattern that reinforces the analyst’s optimistic projections. Between the Halving events of 2012 and 2016, Bitcoin witnessed an impressive 5187% surge in price. Similarly, the four years following the 2016 Halving event saw a nearly 3000% increase in the value of BTC.

The upcoming Bitcoin Halving event is scheduled for April 23, 2024, reducing block rewards from 6.25 units of BTC to 3.125 units. The Bitcoin Halving in 2024 is anticipated to pave the way for a significant influx of funds into the crypto market, fostering a price rally for BTC and other cryptocurrencies.

A Call to Adaptive Strategy

The evolving landscape necessitates a recalibration of investment strategies to incorporate digital assets. As traditional and digital finance converge, investors and institutions must adapt to harness the potential of this new asset class.

At Endemaj Funds, our approach is rooted in embracing innovation while prudently navigating the complexities of this evolving market. We are committed to leveraging these developments to provide our clients with dynamic, forward-thinking investment solutions.

As the CEO of Endemaj Funds, my vision is to embrace these changes, leveraging them to offer our clients innovative investment opportunities while navigating the complexities of this new financial frontier.

My analysis of the past year’s Bitcoin performance and the broader cryptocurrency market leads me to a bullish outlook, a sentiment we are terming the ‘Crypto Spring.’ We are at the cusp of the ‘Crypto Spring’ – a period marked by renewed growth, optimism, and innovation in the cryptocurrency sector. This phase is characterized by:

- Diversification of Crypto Assets – Beyond Bitcoin, the broader crypto market is diversifying, offering a range of investment opportunities.

- Mainstream Adoption – Cryptocurrencies are increasingly becoming part of mainstream finance, with applications in payment systems, remittances, and asset management.

- Technological Integration – Blockchain and crypto are becoming integral to various industries, signaling a shift towards more widespread adoption.

Why We Are Bullish on Bitcoin

- Increased Institutional Adoption – Over the past year, we’ve seen a surge in institutional interest in Bitcoin. Major financial players and corporations have either invested in Bitcoin or integrated it into their services, lending credibility and stability to the market.

- Regulatory Clarity – Gradual advancements in regulatory frameworks, especially in key financial markets, have provided clearer guidelines for institutional participation in cryptocurrency. This development has enhanced investor confidence.

- Technological Advances – Continued innovations in blockchain technology and crypto-based applications have expanded the utility and appeal of Bitcoin beyond just a store of value.

- Market Resilience – Despite volatility, Bitcoin has shown remarkable resilience in bouncing back from market dips. This resilience indicates a maturing market with long-term viability.

Final Thoughts

The financial landscape is on the brink of a transformative phase as the potential approval of Bitcoin ETFs and the approaching Bitcoin Halving event converge to reshape the investment paradigm. The impending decision by the SEC on Bitcoin ETFs stands as a testament to the growing acceptance and maturation of cryptocurrencies within traditional financial structures. This development promises enhanced credibility for digital assets and paves the way for broader accessibility and market stability.

The historical context surrounding Bitcoin Halving events provides compelling insights into the potential trajectory of the cryptocurrency market. Past halving events have catalyzed significant price surges in Bitcoin, underscoring the anticipated impact of the upcoming Halving in 2024. Coupled with the potential approval of Bitcoin ETFs, this event could be a pivotal catalyst, fostering a bullish market sentiment and attracting substantial investments.

As we stand on the threshold of what we term the ‘Crypto Spring,’ characterized by renewed growth, optimism, and innovation, it is imperative for investors and institutions alike to adapt and evolve. The convergence of traditional and digital finance heralds a new era of possibilities, where technological integration, mainstream adoption, and regulatory clarity converge to unlock unprecedented potential.

At Endemaj Funds, we remain steadfast in our commitment to embracing these changes, harnessing the momentum building in the crypto space, and delivering innovative investment strategies that resonate with the dynamic nature of this emerging asset class.

Endemaj Funds has a

disclosure policy.