Authored by Thomas Stray, Endemaj Funds CEO

Thomas Stray is a seasoned investment banker leveraging decades of experience in capital markets, financings and deal structuring, negotiation, and fund raising to identify and capitalise on market opportunities with significant upside.

The year 2023 was anticipated to be rough for many economies, with the imminent threat of a global economic downturn. As the world faces an unpredictable economic recovery, the digital revolution has emerged as a powerful catalyst to accelerate growth and overcome challenges.

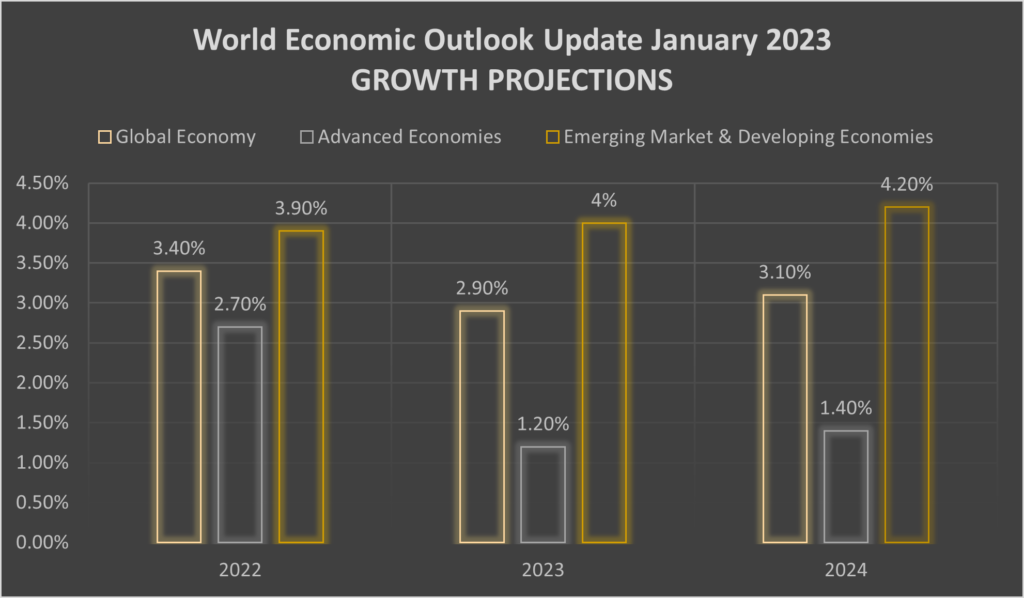

World Economic Outlook

Source: International Monetary Fund

April 2023 has presented an unpredictable economic outlook due to financial sector turmoil, high inflation, the ongoing impact of Russia’s invasion of Ukraine, and the lasting effects of the COVID-19 pandemic. Global growth is expected to drop from 3.4% in 2022 to 2.9% in 2023 before stabilising at 3.1% in 2024.

Advanced economies are predicted to experience a more significant slowdown, with growth falling from 2.7% in 2022 to 1.2% in 2023. Meanwhile, emerging market and developing economies are forecasted to have a minimal increase of 4.0% in 2023 to 4.2% in 2024, respectively.

In an alternative scenario with heightened financial sector stress, global growth could decline to around 2.5% in 2023, with advanced economies witnessing growth below 1%.

Global headline inflation is projected to decrease from 8.7% in 2022 to 7.0% in 2023 due to lower commodity prices. However, core inflation will likely decline more slowly, with most countries unlikely to see a return to target inflation before 2025.

The natural rate of interest plays a crucial role in monetary and fiscal policy, serving as a reference level for monetary policy stance and a determinant of public debt sustainability. Public debt as a ratio to GDP skyrocketed during the pandemic and is anticipated to remain high.

Different approaches to reducing debt-to-GDP ratios have been examined, with fiscal consolidations and comprehensive approaches in cases of debt distress proving effective. Coordination among creditors is essential for long-lasting impacts on reducing debt ratios.

Geoeconomic fragmentation due to supply chain disruptions and increasing geopolitical tensions has taken centre stage in policy debates. This fragmentation can reshape the geography of foreign direct investment (FDI) and influence the global economy. FDI flows are increasingly concentrated among geopolitically aligned countries, particularly in strategic sectors.

Emerging market and developing economies are highly vulnerable to FDI relocation due to their reliance on FDI from geopolitically distant countries. In the long term, FDI fragmentation can lead to substantial output losses, especially for emerging market and developing economies. Multilateral efforts to maintain global integration are crucial to reducing the economic costs of FDI fragmentation.

Accelerating Global Recovery Through Digital Revolution

The digital revolution has already brought significant changes to the global economy and society, and it can play a crucial role in accelerating the global recovery from the current economic downturn. By embracing advanced technologies and fostering digital transformation, we can facilitate a more rapid, inclusive, and sustainable global recovery.

Here are some ways in which the digital revolution can help:

- Boosting productivity and efficiency. The integration of digital tools, such as AI, machine learning, and automation, can optimise processes across industries, reducing costs and enhancing competitiveness. This increased efficiency contributes to economic growth and supports businesses in navigating the current economic landscape.

- Remote work and digital connectivity. The pandemic has fast-tracked the shift towards remote work and digital services. Expanding digital infrastructure enables businesses to operate remotely, creating new job opportunities, reducing regional disparities, and promoting global economic integration.

- E-commerce and digital trade expansion. The growth of e-commerce and digital trade helps drive economic recovery by providing businesses with access to new markets and a wider customer base. This enables SMEs to overcome geographical barriers and compete globally, fostering innovation and economic growth.

- Encouraging innovation and entrepreneurship. The digital revolution offers easier access to information, resources, and capital, stimulating innovation and entrepreneurship. Digital platforms enable entrepreneurs to develop and scale their businesses more efficiently, contributing to job creation and economic growth.

- Digital finance for financial inclusion. Adopting digital financial services, such as mobile banking and online lending, can improve financial inclusion and support economic growth. By promoting economic participation and reducing income inequalities, digital finance contributes to a more inclusive recovery.

- Education and skill development for the digital age. Digital technologies can revolutionise education and skills development, preparing the workforce for the jobs of the future. Investment in digital education is essential for driving economic growth and meeting the growing demand for digital skills.

- Promoting sustainability and environmental resilience. The digital revolution can also contribute to sustainable development and environmental resilience. Advanced technologies, such as IoT, can enable efficient resource management, while AI and data analytics can support better decision-making to address environmental challenges.

To capitalise on the benefits of the digital revolution for global recovery, it is vital for governments, businesses, and individuals to collaborate, develop supportive policies, invest in digital infrastructure, and promote digital literacy and skills development. By harnessing digital technologies, we can overcome the challenges posed by the current economic landscape and work towards a more resilient, inclusive, and sustainable future.

Final Thoughts

The world economy’s tentative signs of a soft landing in early 2023 have faded as stubbornly high inflation and recent financial sector turmoil persist. While inflation has declined due to central banks raising interest rates and lowering food and energy prices, underlying price pressures remain persistent.

The rapid rise in policy rates has led to increased banking sector vulnerabilities and fears of contagion spreading throughout the broader financial sector, including nonbank financial institutions. Downside risks to the global economic outlook have intensified, and the chances of a hard landing have risen sharply.

The digital revolution has the potential to significantly accelerate the global economic recovery by promoting innovation, inclusivity, and sustainability across various sectors. By embracing digital transformation and fostering collaboration between governments, businesses, and individuals, we can not only navigate the current economic challenges but also lay the foundation for long-term growth and prosperity.

Meanwhile, the outlook for precious metals is more positive than that for base metals, with gold and silver prices expected to benefit from the Fed pause and decreasing U.S. real yields during the latter half of 2023. Gold prices are forecasted to reach over $1,860 per troy ounce in the fourth quarter of 2023.

Endemaj Funds has a

disclosure policy.