Authored by Thomas Stray, Endemaj Funds CEO

Thomas Stray is a seasoned investment banker leveraging decades of experience in capital markets, financings and deal structuring, negotiation, and fund raising to identify and capitalise on market opportunities with significant upside.

Endemaj Weekly is a periodic online news and insight space by Endemaj Funds, where we give our readers a quick and easy-to-read snapshot of the current financial landscape, as well as our two cents on topics of finance and investment.

Here, we discuss everything finance – from recent news and the outlook of the global economy to stocks, commodities, and everything in between.

This week, we take a look at collapses in the banking sector, expert forecasts for the global economy, the stock market, and commodities in 2023, as well as the potential impact of the global slowdown on financial conditions.

Recent News

The recent series of banking collapses in the United States has put the public spotlight on financial institutions and their stability.

Negative news about Signature Bank, Silicon Valley Bank (SVB), and even international investment bank Credit Suisse have led consumers to question where they should put their hard-earned money, when the institutions they have long deemed trustworthy are seemingly standing on shaky legs.

To put things in perspective, Signature Bank had over $110 billion in total assets by the end of 2022. Silicon Valley Bank, on the other hand, was a top 20 bank in the United States, with assets totaling nearly $212 billion in 2022. Finally, Credit Suisse is a global systemically important bank that reported over $1.4 trillion in assets under management by the end of 2022.

Of the three, only Credit Suisse remains standing today, with Signature Bank and Silicon Valley Bank suffering inconceivable collapses within weeks of each other. It is also worth noting that Credit Suisse survived only by virtue of the intervention of the Swiss government, which sanctioned a merger between UBS Group AG and Credit Suisse in a government-mediated deal to prevent the Swiss bank’s utter demise.

The collapse of Signature Bank and SVB have prompted this response from United States President Joe Biden to ease tensions towards banks in the U.S.:

“The American people and American businesses can have confidence that their bank deposits will be there when they need them. I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again.”

Joe Biden, President of the United States

Despite such reassurances, however, it is undeniable that all of these events can be considered symptoms of a larger problem affecting markets, financial systems, and economies all around the world today: deep uncertainty.

The Global Economy

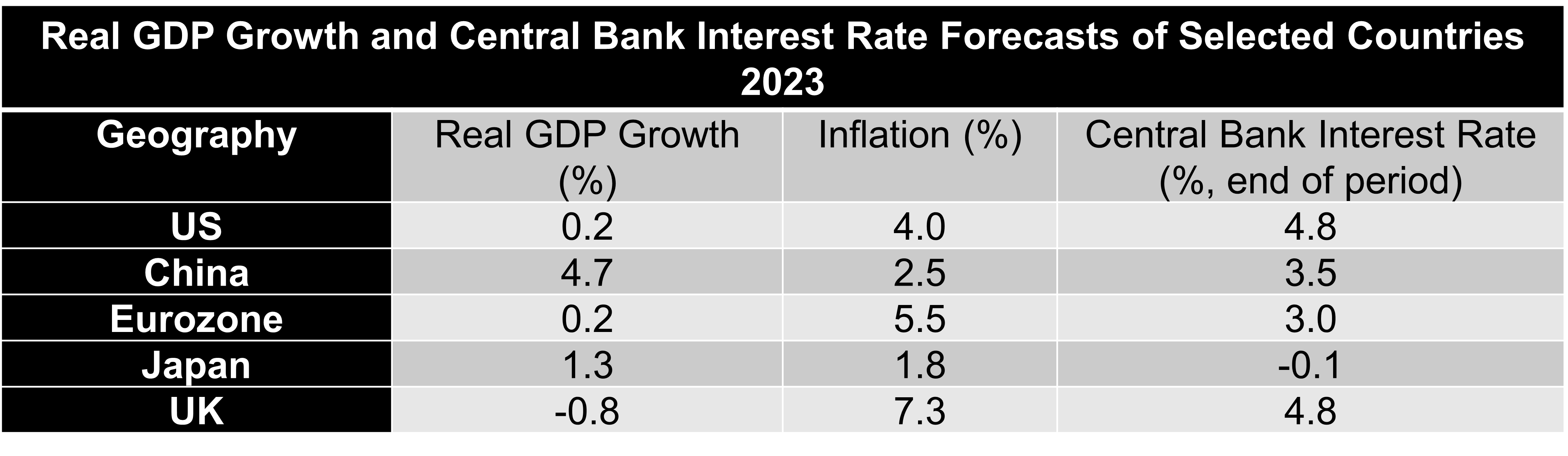

The global economy is set to slump to a three-decade low by 2030. It is expected to grow at a sluggish 1.6 per cent by 2023, mainly due to tightened financial conditions, China’s worsening COVID situation, and Europe’s persistent natural gas crisis.

Source: J.P. Morgan I 2023 Market Outlook: Stocks Set to Fall Near-Term as Economic Growth Slows

J.P. Morgan maintained that the global economy is not at imminent risk of sliding into recession. However, its baseline view assumes that the U.S. recession is likely to happen before the end of 2023. Contributing factors to this include the substantial rise in the borrowing costs, sharp climb in U.S. dollar, and tightening of the credit conditions.

The report Falling Long-Term Growth Prospects by the World Bank Group stated that nearly all the economic forces that powered progress and prosperity over the last three decades are fading. The average potential global GDP growth is expected to decline between 2022 and 2030 by roughly a third of the rate that prevailed in the first decade of this century. This decline could be much steeper in the event of a global financial crisis or recession.

Consequently, according to the World Bank Group, an ambitious policy push is needed to boost productivity and labor supply, ramp up investment and trade, and harness the potential of the service sector.

“The ongoing decline in potential growth has serious implications for the world’s ability to tackle the expanding array of challenges unique to our times—stubborn poverty, diverging incomes, and climate change. But this decline is reversible. The global economy’s speed limit can be raised—through policies that incentivize work, increase productivity, and accelerate investment.”

Indermit Gill, Chief Economist, Senior VP for Development Economics, World Bank

Commodities

Moreover, a sharp decline in inflation could promote growth and prevent an imminent global recession. Inflation can significantly impact the global economy as it can affect consumer purchasing power, the number of investments, interest and exchange rates, and income redistribution.

Forecasted figures by International Monetary Fund indicate that global inflation is expected to fall from 8.8 per cent in 2022 to 6.6 per cent in 2023 and 4.3 per cent in 2024. However, it is still above pre-pandemic (2017–19) levels of about 3.5 per cent.

Global inflation is driven by the increasing demand for goods, with many countries experiencing their highest inflation rates for decades. Following the end of pandemic-induced lockdowns, consumer demand surged as shops opened and people sought to go out and spend the money saved from weeks of inactivity.

However, it is important to note that internal factors are not the only drivers of the current inflation trend. The economic repercussions of the raging conflict in Europe have also had a negative impact on the economy. Due to international restrictions, production constraints, and potential supply chain disruptions, commodity prices have increased under concerns about supply security.

Essential commodities, including wheat, nickel, pig iron, and sunflower seed oil, have seen significant price hikes among the two nations involved in the conflict.

Another area adversely affected by the conflict is the energy sector. Due to the economic sanctions, major economies’ supply of coal, crude oil, and natural gas has been curtailed significantly.

Stock Market

The majority of investors expect that the volatility in the global stock market will continue as interest rates will likely stay higher for a significant amount of time. In the first half of 2023, the S&P 500 is anticipated to re-test the lows of 2022.

The estimated net profit margin for the S&P 500 in Q1 2023 is 11.3%, equal to the previous quarter’s margin but below the 5-year average of 11.4% and the year-ago margin of 12.3%. Meanwhile, the forward 12-month P/E ratio is 17.2, below the 5-year average (18.5) and the 10-year average (17.3).

However, a pivot from the Fed could drive an asset recovery later in the year, pushing the S&P 500 to 4,200 by year-end. The pivot will likely be triggered by a combination of economic weakness, rising unemployment, market volatility, declining risky asset levels, and falling inflation.

These factors are expected to cause or coincide with downside risk in the near term. Considering these factors, J.P. Morgan Research is reducing its below-consensus 2023 S&P 500 earnings per share (EPS) of $225 to $205.

Central Banks

Central banks are expected to pivot and signal interest rate cuts sometime next year, which should result in a sustained recovery of asset prices and the economy by the end of 2023. However, for the pivot to happen, we will witness a combination of increased unemployment, market volatility, economic slow-down, a decline in levels of risky assets, and a fall in inflation.

Based on the research conducted by J.P. Morgan, among 31 countries, 28 have already raised rates, and more are expected to follow. In line with this, based on its current guidance, the Federal Reserve (Fed) will have delivered a cumulative adjustment of close to 500 basis points (bp) on rates through the first quarter of 2023. Fed is expected to pause rate hikes by the end of the first quarter of 2023, followed by other major central banks.

Disinflation is anticipated in 2023, but with few rate cuts across EM central banks, mainly focused on Latin America. EM ex-China and Turkey inflation is forecasted to halve to 4.3% by the end-2023 compared with 7.9% in end-2022.

Source: Euromonitor International Macro Model

"Inflation is expected to remain a problem for central banks in roughly half of the core EM countries. Some EM central banks may start easing next year but most look set to keep rates high for longer..."

Luis Oganes, Head of Currencies, Commodities and Emerging Markets Research, J.P. Morgan

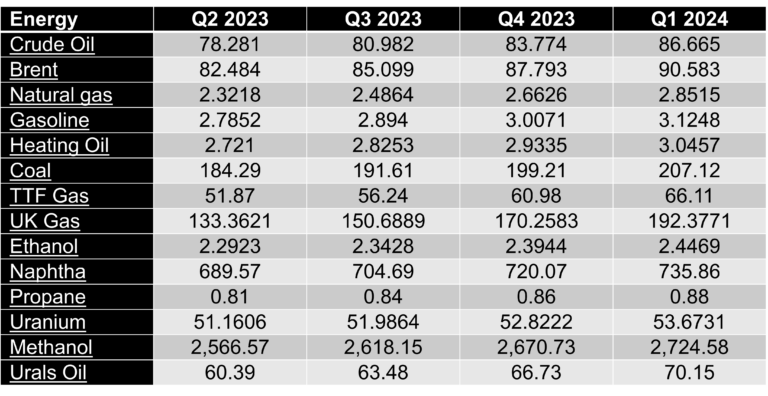

Commodities

The key downside risk for the commodity market in 2023 is the global economic slowdown. Factors contributing to this are the slowing manufacturing activities amid decreasing B2B and consumer demand, weaker capital investment, and lingering recession concerns. Moreover, consumers limit their spending amid a high inflation rate.

The global oil market is forecasted to remain tight but balanced in 2023. The commodity price forecast for Brent oil is expected to average $90 per barrel. This centers on the view that the OPEC+ alliance (Organization of the Petroleum Exporting Countries and Allies) will do the heavy lifting to keep markets balanced. However, the global oil supply expansion is expected to slow in 2024, reviving the need for OPEC’s crude.

Source: Trading Economics, Commodity Forecast 2023/2024

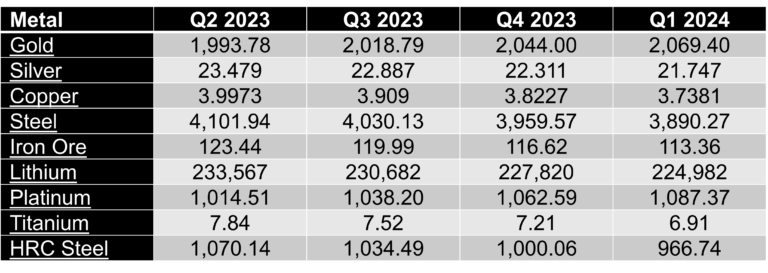

Meanwhile, the outlook for precious metals is more positive than that for base metals, with gold and silver prices expected to benefit from the Fed pause and decreasing U.S. real yields during the latter half of 2023. Gold prices are forecasted to reach over $1,860 per troy ounce in the fourth quarter of 2023.

Source: Trading Economics, Commodity Forecast 2023/2024

Rates and Currencies

The Fed’s tightening policy is expected to culminate in a 50bp hike in December, followed by 25bp hikes in February and March. Rate hikes are anticipated to pause after that.

The tightening financial conditions will likely tip the US economy into a mild recession later in 2023, causing the unemployment rate to rise to 4.3% by year-end. However, the dollar is expected to remain strong in 2023, although its rise may slow down due to the Fed’s pause.

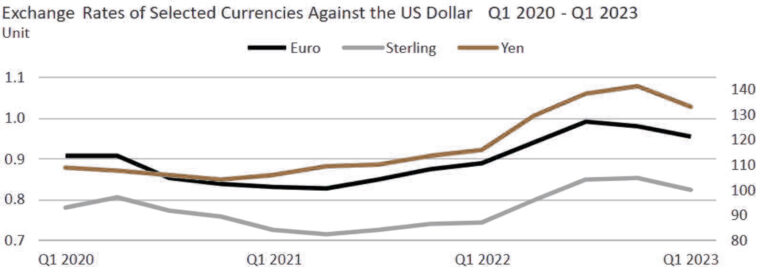

The fluctuations in the US dollar exchange rate play a critical role in the global economy, businesses, and consumers, given its impact on investment, debt, and inflation. It is also widely used by major economies in the world for international trade and finance and serves as the dominant reserve currency for central banks. Its global status became particularly apparent in 2022 after its rapid value surge.

Source: Euromonitor International, US Dollar Exchange Rate Shifts: Drivers, Impacts and Outlook for 2023

Emerging Markets

As growth slows modestly in 2023, emerging markets (EM) face multiple challenges, including tighter global financial conditions, stubbornly high inflation, and unresolved geopolitical stresses from 2022.

This was reflected in the emerging market index performance, which has been underperforming for a while now. The chart below shows the price performance of the MSCI Emerging Markets index (red) and the S&P 500 index (blue) from 2004 to 2022.

Source: Tradingview.com

The global and U.S. economic cycles will remain primary drivers for EM assets, with risky asset classes most affected during U.S. recessions. Dwindling private sector savings will also test EM’s resilience in the face of these challenges.

Despite the disinflation expected in 2023, few rate cuts are anticipated across EM central banks, with easing cycles mainly seen in Latin America, Czechia, and India. Central banks in half of the core EM countries will continue grappling with high inflation, with most keeping rates high for longer. While other EM Asian countries, having lagged in lifting off, are expected to maintain their current stance.

REITs and Real Estate

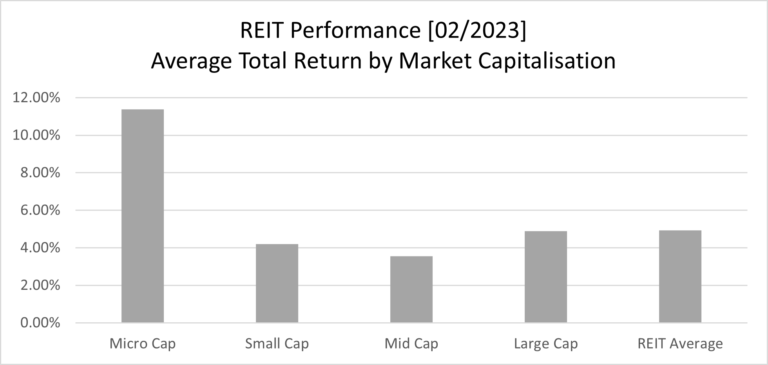

The REIT sector started strong in 2023 with an +11.77% total return. However, REITS gave up some of its gains from January, with a -6.18% return in February. Nevertheless, analysts are still optimistic that REIT’s balance sheets will remain strong, factoring in essential performance metrics like funds from operations and net operating income proving resilient.

Source: Seeking Alpha, Graph by Simon Bowler of 2nd Market Capital, Data compiled from S&P Global Market Intelligence LLC

Real estate investment trusts (REITs) and real estate can provide a degree of diversification for investors in the face of slowing EM growth and other economic challenges. REITs offer an accessible way for investors to gain exposure to real estate assets, benefiting from income generation, potential capital appreciation, and inflation hedging.

Similarly, real estate as an asset class can provide a buffer against market volatility and has historically demonstrated resilience during periods of economic downturns. However, investors should remain cautious and conduct thorough research on individual markets, sectors, and property types to ensure they make informed decisions that align with their investment goals and risk tolerance.

Final Thoughts

In conclusion, both emerging markets and real estate investments carry potential risks and rewards for investors in 2023.

Central banks’ expected pivot to cutting interest rates could bring about a sustained recovery in asset prices and the economy by year-end. Investors should stay informed of these developments and adapt their strategies accordingly.

However, with slowing growth in EM, uncertain global financial conditions, lingering geopolitical stresses, and COVID-19 still causing negative economic repercussions, investors should consider a well-diversified portfolio and maintain a long-term perspective to navigate these challenges.

Furthermore, readers would do well to have a closer look at their chosen banks in light of recent developments in the banking sector. Per Dan Kang, VP of finance at fintech company Mercury Bank, one of the most important metrics to look at when determining the financial health of your bank is your bank’s capital ratios.

Capital ratios measure whether a bank has sufficient capital of its own to absorb losses in its asset book. According to Kang, one capital ratio that is particularly important to look at is your bank’s tier 1 leverage ratio. This refers to the ratio of core capital to risk-adjusted assets, which makes it one of the most relevant indicators of a bank’s financial health.

A healthy tier 1 leverage ratio for most banks is around 6%. However, larger household-name banks often have a ratio around the 6–8% range. If your bank has a tier 1 leverage ratio that is around this range or higher, that is typically an indicator of good financial health.

Stay tuned for our next weekly update on the financial markets from Endemaj Funds by Thomas Stray.

Endemaj Funds has a

disclosure policy.